- Joined

- May 18, 2007

- Messages

- 6,728

- Display Name

Display name:

jsstevens

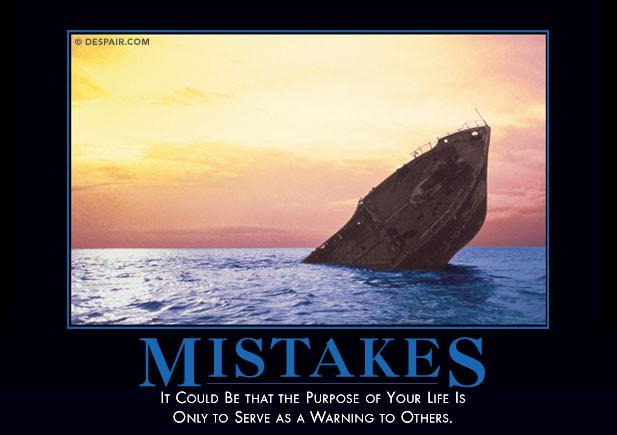

Love the warning! “Don’t make us flip the board over!”LOL!

The Bee has the best “coverage” so far...

https://babylonbee.com/news/wall-st...-top-hat-and-carry-around-giant-bags-of-money