- Joined

- Jun 7, 2008

- Messages

- 23,351

- Display Name

Display name:

Bob Noel

Done to hide the fact it is making metal...

or excessive oil usage

Done to hide the fact it is making metal...

Done to hide the fact it is making metal...

or excessive oil usage

A few years ago, I was considering buying a used A36. Within about 20 minutes of the delivery to my pre-purchase inspection mechanic, he called me and said he was not expecting it to go well...He noticed in the logs (and if you're trying to hide something, I'm not sure why you would log it) that in the past 6 months and about 15 hours, the plane had THREE (!!!) oil changes. Needless to say, it did not do well in our inspection. My mechanic speculated that it had failed 2 other pre-purchase inspections in the past 6 months as well.Actually that would make a lot of sense given engine history... It's 2257H SFOH on the engine. Seems like they're doing a piece-meal overhaul lol.

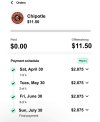

View attachment 120938

Not a plane I'm seriously interested in, but one that has caught my attention since I've seen it on TAP for like... a very long time.

Why bother advertise the oil change at all if that’s the intent?Done to hide the fact it is making metal...

Seeing same in the real estate market I am watching. I think a lot of sellers thought higher interest rates were temporary and hoped to wait it out. Recent Fed comments suggest higher rates are here to stay.Of aircraft that have been listed for 1 month, ~27% now have price cuts (up from 20% over that universe from 10 days ago).

Avg price reduction still hovering around 7%, just quite a few more offering discounts compared to 10 days ago.

Seeing same in the real estate market I am watching. I think a lot of sellers thought higher interest rates were temporary and hoped to wait it out. Recent Fed comments suggest higher rates are here to stay.

I think the era of ‘free’ money is done for a while and people are going to have to restart putting some skin the in the game (cash money down) if financing is going to be a part of the equation.

It’ll take a while for this to settle in as a mindset.

Spot on. It was never sustainable, nor healthy in long term.There seems to be a whole generation of young adults who have had access to virtually free money all of their lives.

*Raises hand.There seems to be a whole generation of young adults who have had access to virtually free money all of their lives.

I've seen exactly the same. PA46s seem to be getting dumped, some with really aggressive price cuts, too.I've been watching the U.S. Malibu/Mirage/Matrix market for the past 18 months. The number of used (searched with 2021 as upper limit of age to eliminate new ads) a/c is 55. Last year the number was about half of that. The prices for Malibu's and older Mirage's have been falling too.

Pretty well describes Xennial/Millennials like myself, at least in the era that it would have had any impact on my purchase of durable goods. Even worse, you might see many refusing (or limiting) the purchase of new goods when interest rates are higher than what they believe are acceptable. Generally good financial sense for not incurring more debt, but not so good for the general economy when people stop buying new cars/boats/aircraft/homes. Slows down velocity quite a bit unless sale prices start dropping by a large margin.There seems to be a whole generation of young adults who have had access to virtually free money all of their lives.

Which is exactly what the Fed is going for.when people stop buying new cars/boats/aircraft/homes.

Or, younger folks will just decide not to incur debt at those rates until they come back down. They have a hard-enough time affording some of the sky-high property values that have occurred over the past decade, much less paying double or triple the interest rate on that inflated property value. I was very fortunate to have purchased my first home in 2010 amid the fallout of the 2008 financial crisis, which not only got me a LOT of house for the money, I also refinanced a few years back for 2.5% on a 15-yr note (was doing a major add-on/new windows/roof). I have no reason/need to move for the next 15years due to having young children in school, but I wouldn't even consider paying 10% interest on a mortgage. I'd just rent and save up the cash to buy outright on the assumption that I wouldn't be dropping $150K in interest on a $300K home in 10 years.Perspective on interest rates is important. I bought my first house at 9%, and later refinanced at 6%. I bought my second house at 6%, and later refinanced to 3% and shortened the term to 20 years. It will be paid off next year.

Right now rates are at approx 7.5%. While that is not free money, neither is it apocalyptic. Younger folks will learn and adapt to changing conditions, just as previous generations did.

I think this is spot on for my age group (mid 30s).Or, younger folks will just decide not to incur debt at those rates until they come back down. They have a hard-enough time affording some of the sky-high property values that have occurred over the past decade, much less paying double or triple the interest rate on that inflated property value. I was very fortunate to have purchased my first home in 2010 amid the fallout of the 2008 financial crisis, which not only got me a LOT of house for the money, I also refinanced a few years back for 2.5% on a 15-yr note (was doing a major add-on/new windows/roof). I have no reason/need to move for the next 15years due to having young children in school, but I wouldn't even consider paying 10% interest on a mortgage. I'd just rent and save up the cash to buy outright on the assumption that I wouldn't be dropping $150K in interest on a $300K home in 10 years.

The 1980's may offer perspective on how high interest rates can be, but it's not something I'd consider acceptable to adapt to unless I was in dire straits.

If velocity of home (new and used) slows down enough because of people refusing to accept high interest rates (not that 7.5% is crazy at the moment), sellers of those home will have to drop pricing to entice buyers into a purchase. So you eventually get either A) lower property values, B) lower interest rates trying to bring more buyers in, or C) both. That ignores whatever strings the Fed/Gov't wants to pull behind the scenes. The Boomer generation has amassed over triple the housing that Millennial/Gen Z has and is perfectly happy with high property values for the most part, as it translates to more money when/if they go to sell it. The market standoff between Boomers and younger generations when that sell-off occurs in earnest will be interesting to see.I think this is spot on for my age group (mid 30s).

Pretty much my entire adult life money has been free or damn close to it. A 2.5-4% mortgage rate is something most people my age kind of took as something you could rely on. Even with rates now being closer to historical norms it's far outside what this group is used to.

Now that they've seen their friends and siblings buy sprawling homes for comparatively low prices AND low rates over the past many years -- the prospect of paying an inflated value with a terrible payment for a much more modest home seems like a losing deal.

Either they'll have to (1) get used to it over time... (2) wait for the next financial disaster so that the fed puts us in a 0% rate environment once again. Not sure what other options they have.

Or they flock to more affordable locations, which is happening in our little town on the outskirts of SAT. Austinites sell their property at bleeding edge prices to people moving to the state from high cost areas, then move to one of the bedroom communities down here that are at lower prices. Those sellers are leaving because they can’t/don’t want to afford the burgeoning property/school tax and then relocating farther out.Or, younger folks will just decide not to incur debt at those rates until they come back down. They have a hard-enough time affording some of the sky-high property values that have occurred over the past decade, much less paying double or triple the interest rate on that inflated property value.….

Yeah, that is an issue tangent to this discussion as well. My parents are sort-of in that situation, as they are a few years from retirement and are looking at land to build a nice (but smaller) home on. Their current home on a couple of acres has almost doubled in value since they built it in 2007 when it was more-or-less out in the boonies. They want more land, but have to move further out from their suburb to get it at a value they are willing to stomach. The urban sprawl keeps pushing people who want a more-rural lifestyle out to areas where land used to be pretty cheap, but prices keep going up due to demand. OK doesn't have nearly the severity of that problem that SAT does, but even the places that are low on the cost-of-living scale are feeling that pinch.Or they flock to more affordable locations, which is happening in our little town on the outskirts of SAT. Austinites sell their property at bleeding edge prices to people moving to the state from high cost areas, then move to one of the bedroom communities down here that are at lower prices. Those sellers are leaving because they can’t/don’t want to afford the burgeoning property/school tax and then relocating farther out.

The convenient to existing infrastructure large and undeveloped tracts of land left to develop 600-home neighborhoods are shrinking in number so those sell at higher prices which in turn cost more to develop, which in turn cost more to build, which results in higher new home sales pricing. Kind of a vicious cycle.

I bought my first home around '88 or 89 and got a 17% note. A refi a few years later yielded a 11.8% note. We though we struck gold. And then...just like 20 years later...a sub prime savings and loan crisis hit and many banks folded (including the one my wife worked for). My current 'jumbo' mortgage is 3.5%. My financial planner keeps bugging me to pay down the loan in anticipation of retirement in a few years. I tell him that if he does his job well I should be making well over 3.5% on my money so it would not make sense to pay off near free money.The 1980's may offer perspective on how high interest rates can be, but it's not something I'd consider acceptable to adapt to unless I was in dire straits.

Yup, which is why I haven't bothered accelerating any payments on the current 15yr mortgage that we're 3 years into. I can always appreciate the feeling of having it "paid for" earlier, but at under 2.5%, it makes zero financial sense to pull money out of savings or investments to do that. Even at S&P 500 averages, you're making 3 times that interest over the long term.I bought my first home around '88 or 89 and got a 17% note. A refi a few years later yielded a 11.8% note. We though we struck gold. And then...just like 20 years later...a sub prime savings and loan crisis hit and many banks folded (including the one my wife worked for). My current 'jumbo' mortgage is 3.5%. My financial planner keeps bugging me to pay down the loan in anticipation of retirement in a few years. I tell him that if he does his job well I should be making well over 3.5% on my money so it would not make sense to pay off near free money.

Lol sounds EXACTLY like what the aviation industry did!A contact I have in a large beverage company is trying to explain how a price elasticity curve isn’t always straight to the executives. When prices get high enough anything becomes elastic.

Executives have raised prices many, many times. Now revenue - and profits - are down. I’ll give you 10 to 1 odds that they will raise prices again and be shocked, shocked I say when people buy even less.

I need used airplane prices to drop and the stock market to go up a little so I can pay cash. Can anyone arrange that ?

Labor is only 15% of a car price. Automakers have been making record profits. But any excuse to raise prices, I guess.I'm interested to see what new car/truck pricing does after all of a the UAW negotiations get finalized. We have already hit the peak on used car pricing, but once the impact of those price increases on new cars from the Big 3 hit consumers, we may see support for another jump in used car pricing.

Yup. A 20% increase in labor cost won't get by without a corresponding increase in sales price. Otherwise the stock market would balk at reduced profits and the execs stock options would be worth less. Can't have that!Labor is only 15% of a car price. Automakers have been making record profits. But any excuse to raise prices, I guess.

Appreciate you for being a team player!Easy peasy, I can just sell my stock and put my plane up for sale.