RJM62

Touchdown! Greaser!

- Joined

- Jun 15, 2007

- Messages

- 13,157

- Location

- Upstate New York

- Display Name

Display name:

Geek on the Hill

O

Rich

Rich

yup.....I almost bit on that....but, didn't. I might take a bite when it pulls back.ROKU just had a big pop in the last coupla weeks. May be little ahead of itself right now.

yup.....I almost bit on that....but, didn't. I might take a bite when it pulls back.

That suggests you’re trying to “time the market” to some extent. If you think it’s a good company with growth potential, I’d go ahead and buy it regardless of daily fluctuations.

Oh, and my mention of cannabis stocks was just a facetious jab at Half Fast’s “Booze” recommendation. Though, truth be told we do have tiny positions in two of them.

Whenever I used the “editorial we”, my mom would ask, “What? Is there a mouse in your pocket?”

I'd like to invest in "cord cutting" (maybe ROKU, HULU) stocks and sell short Dish, Direct, and other worthless old fashioned providers.

There's never a bad time to buy O, especially with DRP.

If your time horizon is long enough....

If your time horizon is long enough, that appears to be true, although there have been times when it took a few years to start making money.

http://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=&symb=o&x=58&y=6&time=20&startdate=1/4/1999&enddate=10/28/2019&freq=2&compidx=aaaaa:0&comptemptext=&comp=none&ma=0&maval=9&uf=0&lf=1&lf2=0&lf3=0&type=128&style=320&size=2&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=9

Yeah, but look at it compared to other equities during those periods. O actually did better than most.

EDIT: And remember, we're talking monthly dividends, making it ideal for DRP.

It's had its bear markets though.I like gold as an investment, because I don't think gold will ever go to zero, or even really low. It may dip occasionally, but that is when i buy more, so dips are good.

I like gold too. It's about 1% of my portfolio. Since 2006, it has almost been keeping up with the Dow index.I like gold as an investment, because I don't think gold will ever go to zero, or even really low. It may dip occasionally, but that is when i buy more, so dips are good.

I’ve made a lot more than I would have if it was all in a coffee can in the freezer.Self explanatory.

I own some gold. I don’t really count it as an “investment”, per sé, more like a hedge against hyper-inflation.

Not that I expect hyper-inflation, but it seems reasonable to have some insurance against it.

We are currently in one of the longest Bull Markets in history. It will not go on forever.

The 3-month/10-year bond yield curve was recently inverted. Historically this has preceded every recession since 1956.

The S&P 500 is at or near it's all time high.

Sounds like a good time to take profits.

I consider my investment in my Bonanza as good as gold....

We are currently in one of the longest Bull Markets in history. It will not go on forever.

The 3-month/10-year bond yield curve was recently inverted. Historically this has preceded every recession since 1956.

The S&P 500 is at or near it's all time high.

Sounds like a good time to take profits.

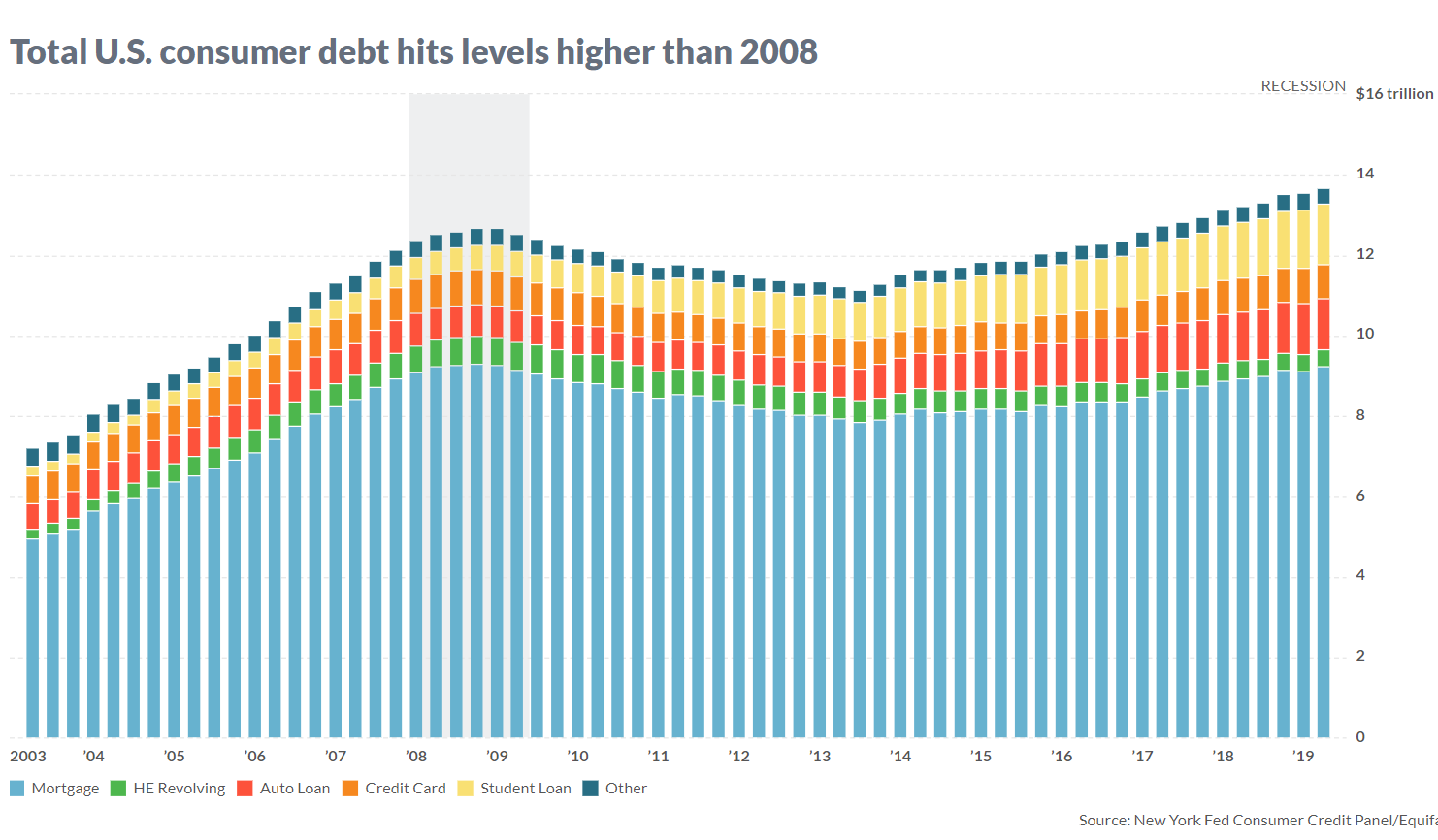

Going to need more than an inverted yield curve and “we’re past due” to support that recession claim. Generally recessions have a large bubble that gets corrected in the market (dot com, mortgages) Is there a particular bubble you think is getting ready to have a large correction? Consumer debt? Fed monetary policy?

All inverted bond yields? No, there was once it didn’t happen.

what I see is that so many seem determined to have a recession, which greatly increases the chances of it actually happening.

Going to need more than an inverted yield curve and “we’re past due” to support that recession claim. Generally recessions have a large bubble that gets corrected in the market (dot com, mortgages) Is there a particular bubble you think is getting ready to have a large correction? Consumer debt? Fed monetary policy?

Last time I saw the graphic of consumer debt, student loans were increasing as a proportion of total consumer debt, but it didn't just jump off the page because the growth was so tremendous over the past few years. From when I graduated ('06) it has gone haywire though. I'll see if I can find it.If I was looking for a bubble, I'd be looking at student loan debt. Can't shuck it off with bankruptcy and we've had irrational exuberance pushed by culture ("A degree is the way to a high paying job") and the for-profit universities with cheap money flooding the market. Now it' snot a traditional bubble with soaring asset prices, but a big hole in the market none the less.

I consider my investment in my Bonanza as good as gold....

Actually, most bubbles are generally determined after the fact.

From what I recall, recession usually start in one area of the economy and slowly spread. You can look at a few areas now and wonder if they will spread:

1. Auto loans. Default rates are climbing, rather quickly.

2. Manufacturing, negative growth now for a couple of quarters and employment way down

3. Export/import trade, negative export growth rate

4. Agriculture, affected by negative exports

5. Low wage, unskilled labor market. Look at the increasing level of automation. It is slowly eating away at the bottom 50% of the labor market. Not sure when we reach a tipping point.

Tim

Yes. I keep several hundred pounds of the brass, lead, and copper about, just in case.I also hedge in precious metals, primarily brass and lead. Seems more practical and immediately useful than gold.

Falling back on my conditional acceptance of the Efficient Market Hypothesis and Random Walk Theory...

Everything we’re discussing here is public information, already factored in by market players. So the market is exactly where it’s “supposed” to be, and at any given moment is just as likely to go up as down.

There’s always someone predicting Armageddon, and someday they might be right. Again, let me recommend this book for a glimpse into how random it all probably is:

I read Black Swan. Do you have Antifragile?