HouTxPilot82

Pre-takeoff checklist

- Joined

- Nov 6, 2014

- Messages

- 286

- Display Name

Display name:

HouTxPilot82

The flight school where I did all my training and still rent aircraft from whenever I want to fly has a requirement for Renters insurance when you're not with a CFI. I signed up for a yearly policy through the AOPA website on the day of my first solo last year in July, while still obviously a student pilot. It was $261 for a year long policy with coverage limits of 250/25/10.

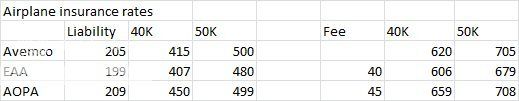

I just received an email renewal for the next year which quotes $236. Are these the standard going rates? Taking a quick look through the policy there is an assumption made that I have a private pilot rating (which I do), but since I haven't reapplied myself providing any updates on my ratings, flight hours, etc.... I was wondering what factored into this rate, and if this is decent coverage for the rate or not.

I'd love to hear any input from others on what they are paying, if I should look at any other specific insurance providers, etc.

Thanks.

I just received an email renewal for the next year which quotes $236. Are these the standard going rates? Taking a quick look through the policy there is an assumption made that I have a private pilot rating (which I do), but since I haven't reapplied myself providing any updates on my ratings, flight hours, etc.... I was wondering what factored into this rate, and if this is decent coverage for the rate or not.

I'd love to hear any input from others on what they are paying, if I should look at any other specific insurance providers, etc.

Thanks.