That would be an important number. If the number on the market has fallen it may mean that the reduced prices are a result of only less desirable examples available.@GeorgeC Do you have a count of number of 172's for sale?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I’m calling the peak

- Thread starter AA5Bman

- Start date

eman1200

Touchdown! Greaser!

- Joined

- Mar 10, 2013

- Messages

- 18,882

- Location

- Oakland, CA

- Display Name

Display name:

Bro do you even lift

$291,012 ave price for 340s 11/1/2022

$278,219 ave price for 340s 1/3/2023

$267,906 ave price for 340s 2/3/2023

$253,613 ave price for 340s 3/4/2023

$261,594 ave price for 340s 4/3/2023

$248,822 ave price for 340s 5/3/2023

$266,744 ave price for 340s 6/3/2023

$275,909 ave price for 340s 7/2/2023

$197,910 ave price for baron 11/1/2022

$185,057 ave price for baron 1/3/2023

$169,502 ave price for baron 2/3/2023

$191,411 ave price for baron 3/4/2023

$186,757 ave price for baron 4/3/2023

$190,231 ave price for baron 5/3/2023

$209,694 ave price for baron 6/3/2023

$196,829 ave price for baron 7/2/2023

$278,219 ave price for 340s 1/3/2023

$267,906 ave price for 340s 2/3/2023

$253,613 ave price for 340s 3/4/2023

$261,594 ave price for 340s 4/3/2023

$248,822 ave price for 340s 5/3/2023

$266,744 ave price for 340s 6/3/2023

$275,909 ave price for 340s 7/2/2023

$197,910 ave price for baron 11/1/2022

$185,057 ave price for baron 1/3/2023

$169,502 ave price for baron 2/3/2023

$191,411 ave price for baron 3/4/2023

$186,757 ave price for baron 4/3/2023

$190,231 ave price for baron 5/3/2023

$209,694 ave price for baron 6/3/2023

$196,829 ave price for baron 7/2/2023

masloki

Pattern Altitude

- Joined

- Aug 23, 2011

- Messages

- 2,036

- Display Name

Display name:

Nunya

Happy birthday?$291,012 ave price for 340s 11/1/2022

$278,219 ave price for 340s 1/3/2023

$267,906 ave price for 340s 2/3/2023

$253,613 ave price for 340s 3/4/2023

$261,594 ave price for 340s 4/3/2023

$248,822 ave price for 340s 5/3/2023

$266,744 ave price for 340s 6/3/2023

$275,909 ave price for 340s 7/2/2023

$197,910 ave price for baron 11/1/2022

$185,057 ave price for baron 1/3/2023

$169,502 ave price for baron 2/3/2023

$191,411 ave price for baron 3/4/2023

$186,757 ave price for baron 4/3/2023

$190,231 ave price for baron 5/3/2023

$209,694 ave price for baron 6/3/2023

$196,829 ave price for baron 7/2/2023

eman1200

Touchdown! Greaser!

- Joined

- Mar 10, 2013

- Messages

- 18,882

- Location

- Oakland, CA

- Display Name

Display name:

Bro do you even lift

Happy birthday?

Similar technique

schmookeeg

En-Route

yeah I could see the baron "quality mix" accounting for these variations. there are 50k barons and 500k barons and 1.5MM barons, so this average is sort of difficult to suss anything out of.

Don't know enough about 340s to know if that's a trend worth using, seems like it might be? do 340s vary that widely in their ask price?

Don't know enough about 340s to know if that's a trend worth using, seems like it might be? do 340s vary that widely in their ask price?

WDD

Final Approach

- Joined

- Oct 16, 2019

- Messages

- 5,368

- Location

- Atlanta / KRYY

- Display Name

Display name:

Vintage Snazzy (so my adult children say)

Someday I might just get frustrated and say I just won’t live past age 75, cash out a huge part of the IRAs and just pay a stupid amount of money for a plane. So that I’m able to continually pay a stupid amount each month for insurance, fuel, tie down fees, etc.

eman1200

Touchdown! Greaser!

- Joined

- Mar 10, 2013

- Messages

- 18,882

- Location

- Oakland, CA

- Display Name

Display name:

Bro do you even lift

yeah I could see the baron "quality mix" accounting for these variations. there are 50k barons and 500k barons and 1.5MM barons, so this average is sort of difficult to suss anything out of...

it's limited to BE55's listed with a price > $1 in the US. and it's only meant to show a trend and whether that's peaked or not.

schmookeeg

En-Route

it's limited to BE55's listed with a price > $1 in the US. and it's only meant to show a trend and whether that's peaked or not.

there are no 1.5MM 55s, but there are still 50k and 500k 55s. I think that wide of a variance makes it hard to pin down a trend. The beeches just have too many STCs and mods available, none are like any other.

Trust me, I want barons to be appreciating

kaiser

Pattern Altitude

- Joined

- Mar 6, 2019

- Messages

- 2,266

- Location

- Chicagoland

- Display Name

Display name:

The pilot formerly known as Cool Beard Guy

As I’m in the market for a Baron…

ReportedI want barons to be appreciating

eman1200

Touchdown! Greaser!

- Joined

- Mar 10, 2013

- Messages

- 18,882

- Location

- Oakland, CA

- Display Name

Display name:

Bro do you even lift

$291,012 ave price for 340s 11/1/2022

$278,219 ave price for 340s 1/3/2023

$267,906 ave price for 340s 2/3/2023

$253,613 ave price for 340s 3/4/2023

$261,594 ave price for 340s 4/3/2023

$248,822 ave price for 340s 5/3/2023

$266,744 ave price for 340s 6/3/2023

$275,909 ave price for 340s 7/2/2023

$269,950 ave price for 340s 8/3/2023

$197,910 ave price for baron 11/1/2022

$185,057 ave price for baron 1/3/2023

$169,502 ave price for baron 2/3/2023

$191,411 ave price for baron 3/4/2023

$186,757 ave price for baron 4/3/2023

$190,231 ave price for baron 5/3/2023

$209,694 ave price for baron 6/3/2023

$196,829 ave price for baron 7/2/2023

$235,570 ave price for baron 8/3/2023

$278,219 ave price for 340s 1/3/2023

$267,906 ave price for 340s 2/3/2023

$253,613 ave price for 340s 3/4/2023

$261,594 ave price for 340s 4/3/2023

$248,822 ave price for 340s 5/3/2023

$266,744 ave price for 340s 6/3/2023

$275,909 ave price for 340s 7/2/2023

$269,950 ave price for 340s 8/3/2023

$197,910 ave price for baron 11/1/2022

$185,057 ave price for baron 1/3/2023

$169,502 ave price for baron 2/3/2023

$191,411 ave price for baron 3/4/2023

$186,757 ave price for baron 4/3/2023

$190,231 ave price for baron 5/3/2023

$209,694 ave price for baron 6/3/2023

$196,829 ave price for baron 7/2/2023

$235,570 ave price for baron 8/3/2023

Houses and hangars are inexpensive if you want to live where they are inexpensive. Nowadays communication and travel has allowed more people to see where they’d prefer to live and as a result of competition to live where everybody else wants to live, and higher total population, prices and rents are high.

I live where I grew up, happily it’s always been a nice place. I spent 33 years buying and paying off two rental properties, initially with an 11% mortgage and $1500 costs paid out of a $2700 gross income, living in one of them with a room mate. Nowadays I keep the rent on both well below market and the combined rent is still $6K. Both tenants are in jobs where they could live anywhere - one in online sales, working from home, the other an MD. I think they are unwise but the rent pays for my too expensive hangar, among other things.

My plane meanwhile cost only $35K because I didn’t want to waste too much money on toys. I don’t care about the peaks and valleys of aircraft value because mine was bought inexpensively and is paid off. I’d recommend that approach.

I live where I grew up, happily it’s always been a nice place. I spent 33 years buying and paying off two rental properties, initially with an 11% mortgage and $1500 costs paid out of a $2700 gross income, living in one of them with a room mate. Nowadays I keep the rent on both well below market and the combined rent is still $6K. Both tenants are in jobs where they could live anywhere - one in online sales, working from home, the other an MD. I think they are unwise but the rent pays for my too expensive hangar, among other things.

My plane meanwhile cost only $35K because I didn’t want to waste too much money on toys. I don’t care about the peaks and valleys of aircraft value because mine was bought inexpensively and is paid off. I’d recommend that approach.

Last edited:

Wagondriver

Line Up and Wait

- Joined

- Mar 7, 2020

- Messages

- 636

- Display Name

Display name:

375Taylor

There are two C180's listed right now for just under $100k, I haven't seen anything under $100k in a few years. It looks like across the board that prices on c180 and c185 are coming down a bit.

Grum.Man

En-Route

Right now we are in the phase where sellers aren’t lowering their prices but the planes aren’t selling. Guess it’s the denial phase.

There are two C180's listed right now for just under $100k, I haven't seen anything under $100k in a few years. It looks like across the board that prices on c180 and c185 are coming down a bit.

I’ve noticed the same with the 180s, and the same thing is happening with Super Cubs. Not too long ago I would have listed my solidly average PA18 for no less than $135 and it would have sold immediately, now I’ve seen a few that are equal or nicer to mine sit on the market at that price.

The 180/185 and PA18 are the airframes I would have expected to have some of the best price retention and even they’re suffering right now. I expect it will only get worse.

Baked Potato

Line Up and Wait

- Joined

- Jul 31, 2022

- Messages

- 930

- Display Name

Display name:

Baked Potato

Not sure if it's been brought up in this thread but I'm wondering if MOSAIC passes in its current form then prices of newly-eligible planes (172s, Cherokees, etc) will noticably increase due to an increase in the number of pilots who can fly them.

The airframes you mentioned are already higher priced due to the demand for them from flight schools. As written I don’t see MOSAIC doing much of anything those airplanes.Not sure if it's been brought up in this thread but I'm wondering if MOSAIC passes in its current form then prices of newly-eligible planes (172s, Cherokees, etc) will noticably increase due to an increase in the number of pilots who can fly them.

When MOSAIC becomes law, there will be more people looking to purchase aircraft, from what is essentially a fixed quantity inventory. More demand for comodity with fixed quantity equals price increase. Doesn’t matter that price is already high due to other demand forces. New increase in demand on fixed quantity = price increase. Economics 101. A new upward trend is about to begin for aircraft that qualify under MOSAIC, if MOSAIC becomes law, and maybe before, if speculation kicks in.

idahoflier

Pattern Altitude

- Joined

- Jul 21, 2017

- Messages

- 1,611

- Display Name

Display name:

idahoflier

I think they will increase. My C172N already has. Quite surprised at the asking price of some of them!Not sure if it's been brought up in this thread but I'm wondering if MOSAIC passes in its current form then prices of newly-eligible planes (172s, Cherokees, etc) will noticably increase due to an increase in the number of pilots who can fly them.

Country Flier

Line Up and Wait

- Joined

- Sep 20, 2019

- Messages

- 992

- Display Name

Display name:

CFL

I’ve noticed this too.Right now we are in the phase where sellers aren’t lowering their prices but the planes aren’t selling. Guess it’s the denial phase.

TaP has 2255 single engine for sale…highest I’ve ever seen.

Where do you get these numbers? Is there a resource to look up the trends of other make/models?$291,012 ave price for 340s 11/1/2022

$278,219 ave price for 340s 1/3/2023

$267,906 ave price for 340s 2/3/2023

$253,613 ave price for 340s 3/4/2023

$261,594 ave price for 340s 4/3/2023

$248,822 ave price for 340s 5/3/2023

$266,744 ave price for 340s 6/3/2023

$275,909 ave price for 340s 7/2/2023

$269,950 ave price for 340s 8/3/2023

$197,910 ave price for baron 11/1/2022

$185,057 ave price for baron 1/3/2023

$169,502 ave price for baron 2/3/2023

$191,411 ave price for baron 3/4/2023

$186,757 ave price for baron 4/3/2023

$190,231 ave price for baron 5/3/2023

$209,694 ave price for baron 6/3/2023

$196,829 ave price for baron 7/2/2023

$235,570 ave price for baron 8/3/2023

eman1200

Touchdown! Greaser!

- Joined

- Mar 10, 2013

- Messages

- 18,882

- Location

- Oakland, CA

- Display Name

Display name:

Bro do you even lift

I have an automated process that does the searching for me. it basically searches TaP and controller for B55's and cessna 340's in the US with a price >= $1 (so it doesn't include "call for price" listings) and pipes those listings out to a file. I just post it every month, so it's not looking at historical prices, I'm just keeping track of them on a monthly basis.Where do you get these numbers? Is there a resource to look up the trends of other make/models?

MooneyDriver78

En-Route

- Joined

- Aug 13, 2013

- Messages

- 4,541

- Display Name

Display name:

Tom

I have an automated process that does the searching for me. it basically searches TaP and controller for B55's and cessna 340's in the US with a price >= $1 (so it doesn't include "call for price" listings) and pipes those listings out to a file. I just post it every month, so it's not looking at historical prices, I'm just keeping track of them on a monthly basis.

I would also count the number for sale, I think this would give an earlier indication of market trends. I remember a couple of years ago there was only 7 Mooney Js for sale on controller, today there’s 22 not counting missiles.

3 are CFP. 1 is an auction and starting bid is $50,000. (but no inspections are allowed, they only guarantee the title will be free and clear….okay?!)

Agree, increase in inventory (i.e. supply) *can be* a leading indicator for price trends, being 50% of that whole Econ 101 supply/demand thing. The thing is, what is happening with demand? That is harder to deduce in real-time. Also, with such small numbers of total inventory of any one particular aircraft type, the quality and asking price of each individual aircraft has excessive influence on the averages. Add to this the phenomenon of strong markets bringing out the vultures who are trying to dump their trash while the market is hot, so that can drive up supply of planes that sit longer due to condition. With all of that considered, median pricing and time on market are probably the better statistics to apply here - although even those are limited in utility due to the small sample size.I would also count the number for sale, I think this would give an earlier indication of market trends. I remember a couple of years ago there was only 7 Mooney Js for sale on controller, today there’s 22 not counting missiles.

3 are CFP. 1 is an auction and starting bid is $50,000. (but no inspections are allowed, they only guarantee the title will be free and clear….okay?!)

Grum.Man

En-Route

I obviously don't follow every make and model but there are a few I've been interested in for years and keep an eye on. Over the last 3 years if you didn't get to it within the first week or two you were S.O.L. Now it seems only the really well priced examples are moving.

It seems for what ever reason people seem to have adopted only half of the TBO recommendation from Lycoming. Comically there is more documented proof that an engine that sits is way worse off than one that is past TBO that's flown regularly. Yet when you tell someone their 30 year old engine is past TBO and only worth core value they don't care. Yet, if that same airplane was 200 hours past TBO at 10 years old they would be begging someone to take it. To claim your 30 year old engine with 600 hours hasn't hit TBO is the same as saying your 5000 hour engine that's 10 years old hasn't hit TBO. I know it's not a requirement and no I wouldn't tear and engine down just because it was old or had a bunch of hours. It is a pricing tool though that people seemed to have lost sight of, or maybe not given the demand for cylinders and overhaul shops right now!

It seems for what ever reason people seem to have adopted only half of the TBO recommendation from Lycoming. Comically there is more documented proof that an engine that sits is way worse off than one that is past TBO that's flown regularly. Yet when you tell someone their 30 year old engine is past TBO and only worth core value they don't care. Yet, if that same airplane was 200 hours past TBO at 10 years old they would be begging someone to take it. To claim your 30 year old engine with 600 hours hasn't hit TBO is the same as saying your 5000 hour engine that's 10 years old hasn't hit TBO. I know it's not a requirement and no I wouldn't tear and engine down just because it was old or had a bunch of hours. It is a pricing tool though that people seemed to have lost sight of, or maybe not given the demand for cylinders and overhaul shops right now!

Got it, so it's just list prices too not sale prices?I have an automated process that does the searching for me. it basically searches TaP and controller for B55's and cessna 340's in the US with a price >= $1 (so it doesn't include "call for price" listings) and pipes those listings out to a file. I just post it every month, so it's not looking at historical prices, I'm just keeping track of them on a monthly basis.

eman1200

Touchdown! Greaser!

- Joined

- Mar 10, 2013

- Messages

- 18,882

- Location

- Oakland, CA

- Display Name

Display name:

Bro do you even lift

Got it, so it's just list prices too not sale prices?

Yes. Not sure how anyone would know actual sale prices.

Didn't know if there was some data from broker sales, etc. Plenty of other industry groups compile data similar to that and while it wouldn't be perfect, it'd be something. AOPA could certainly try to gather data like that to provide for members, through surveys, brokers, etc.Yes. Not sure how anyone would know actual sale prices.

EdFred

Taxi to Parking

Didn't know if there was some data from broker sales, etc. Plenty of other industry groups compile data similar to that and while it wouldn't be perfect, it'd be something. AOPA could certainly try to gather data like that to provide for members, through surveys, brokers, etc.

Yeah because the $1 and other valuable consideration is really a good benchmark on what it actually sold for.

Barnstormers. Aug 4 2023. Review of Cessna 172N listed for sale.

11 aircraft identified for sale with clearly stated list price.

Average list price = $123,204. High = $180,000. Low = $40,000.

Average Engine SMOH = 1,140 hours. High = 3,300. Low = 0.

11 aircraft identified for sale with clearly stated list price.

Average list price = $123,204. High = $180,000. Low = $40,000.

Average Engine SMOH = 1,140 hours. High = 3,300. Low = 0.

"..Doesn’t matter that price is already high due to other demand forces. New increase in demand on fixed quantity = price increase. Economics 101.…

Except recreational owners don’t usually amortize out a purchase based on CapEx, OpEx, ROI, and tax structures that justify ownership of a business asset.

To wit, I know of a G1000 172 with not one, but two incidents each resulting in a a sheared off nose gear, sudden stoppage and bent firewall. That plane is renting for $220/hr and is flying 35 hrs/month. The bottom of that market is $190K with a runout motor. But it’s an income producing TAA competing in the rental market against SR20s and DA40s priced a C-note higher per hour so it can command both the selling price and hourly rental price.

Joe Blow MOSAIC owner ain’t in that market.

Pinecone

En-Route

I think they will increase. My C172N already has. Quite surprised at the asking price of some of them!

Prices for 172s and PA28s are up due to increased flight training and needing trainers. My FBO went from 3 172 2 years ago to 5 on the line now.

Rcmutz

Cleared for Takeoff

You looking to buy a twin? Might be tough to get in and out of RR.I have an automated process that does the searching for me. it basically searches TaP and controller for B55's and cessna 340's in the US with a price >= $1 (so it doesn't include "call for price" listings) and pipes those listings out to a file. I just post it every month, so it's not looking at historical prices, I'm just keeping track of them on a monthly basis.

eman1200

Touchdown! Greaser!

- Joined

- Mar 10, 2013

- Messages

- 18,882

- Location

- Oakland, CA

- Display Name

Display name:

Bro do you even lift

You looking to buy a twin? Might be tough to get in and out of RR.

whachoo talkin 'bout willis? @Lance F landed his 414 and made the first turnoff at RR. of course there is only one turnoff at RR, but nonetheless......

UngaWunga

Pattern Altitude

- Joined

- Oct 27, 2014

- Messages

- 1,968

- Display Name

Display name:

UngaWunga

So the strippers were on the larger side?Look… I’ve seen the special items you have brought in. Got to watch that GW!

eman1200

Touchdown! Greaser!

- Joined

- Mar 10, 2013

- Messages

- 18,882

- Location

- Oakland, CA

- Display Name

Display name:

Bro do you even lift

So the strippers were on the larger side?

I think he means they were on the grosser side

charheep

Cleared for Takeoff

Dont kink shame meI think he means they were on the grosser side

ArrowFlyer86

Pattern Altitude

- Joined

- Jul 17, 2019

- Messages

- 1,559

- Location

- Chicago suburbs

- Display Name

Display name:

The Little Arrow That Could

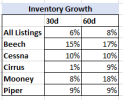

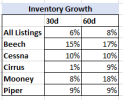

Per my janky little process that just started 2 months ago I have: +6% listing growth past 30d, +8% past 60d per TAP. Only single engine piston.

It only counts total inventory with breakouts for the major mfrs -- no price data collected. Not sure how much is due to seasonality.

And like everyone else I'm seeing the same listings posted over and over... and over again (and it's beginning to ruin my evening pastime activity of scrolling through TAP with a beer in my hand)...

And VB's inventory doesn't seem to be moving at all. The plane I asked about 6 months ago is still sitting there. Wondering if people will ever start taking lower bids.

It only counts total inventory with breakouts for the major mfrs -- no price data collected. Not sure how much is due to seasonality.

And like everyone else I'm seeing the same listings posted over and over... and over again (and it's beginning to ruin my evening pastime activity of scrolling through TAP with a beer in my hand)...

And VB's inventory doesn't seem to be moving at all. The plane I asked about 6 months ago is still sitting there. Wondering if people will ever start taking lower bids.

kaiser

Pattern Altitude

- Joined

- Mar 6, 2019

- Messages

- 2,266

- Location

- Chicagoland

- Display Name

Display name:

The pilot formerly known as Cool Beard Guy

It would be interesting to see how much listings (tail numbers?) have to age before prices truly capitulate.Per my janky little process that just started 2 months ago I have: +6% listing growth past 30d, +8% past 60d per TAP. Only single engine piston.

It only counts total inventory with breakouts for the major mfrs -- no price data collected. Not sure how much is due to seasonality.

View attachment 119822

And like everyone else I'm seeing the same listings posted over and over... and over again (and it's beginning to ruin my evening pastime activity of scrolling through TAP with a beer in my hand)...

And VB's inventory doesn't seem to be moving at all. The plane I asked about 6 months ago is still sitting there. Wondering if people will ever start taking lower bids.

WDD

Final Approach

- Joined

- Oct 16, 2019

- Messages

- 5,368

- Location

- Atlanta / KRYY

- Display Name

Display name:

Vintage Snazzy (so my adult children say)

My hunch. The guys listing now won’t drop. The planes will rot. It will be the next wave of new sellers that will have their initial asking price lower.