This comment had me wondering so I grabbed the median household income from the St. Louis Fed and ran some numbers.

Obviously as a quick back of the napkin number check, there's assumptions here. Like saying "the majority" is a bell curve around the median.

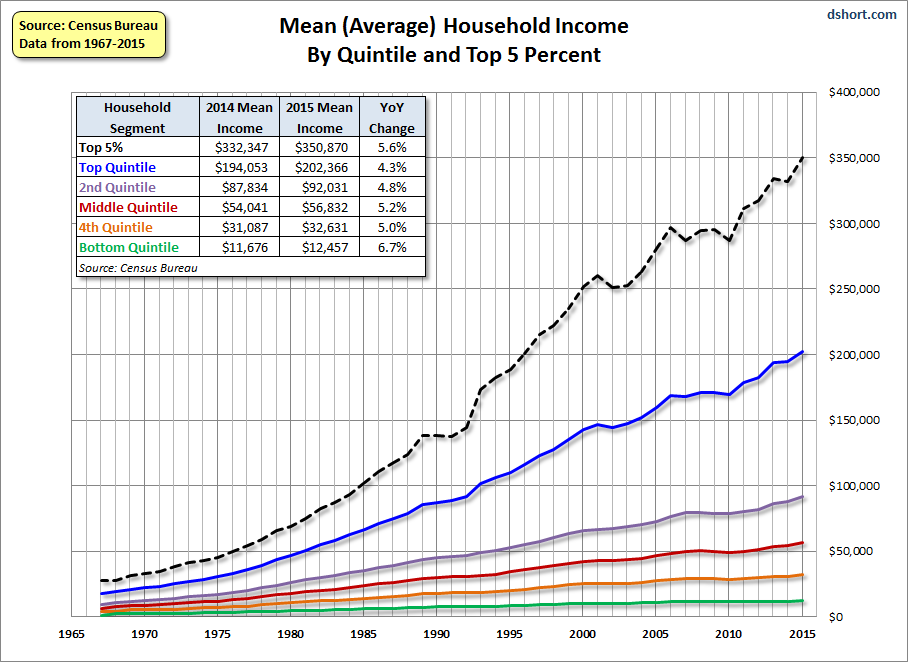

$56,000/year, investing 10% of that, for 40 years, at a 4% return (that's ultra conservative) yields about half a million bucks.

So you'd be living off of 50,000/year, investing roughly $6000, for the working years to get that.

Then you'd expect to live on about $25,000/year in retirement with everything paid off, and do that for 20 years.

It isn't gravy train, but it's not starving either. Assuming you avoided consumer debt like the plague and paid off the house.

The big bankrupter in that estimate is medical issues. And that's where your statement probably becomes accurate. In normal health, the median can keep themselves in a similar lifestyle as they had throughout life with a simple consistent 10% investment.

If they decided to spend every penny and start thinking about retirement 20 years too late, that's not going to work.

But smart upstanding citizens taught compound interest by our top notch schools would never do that... right?

Oh. Wait...