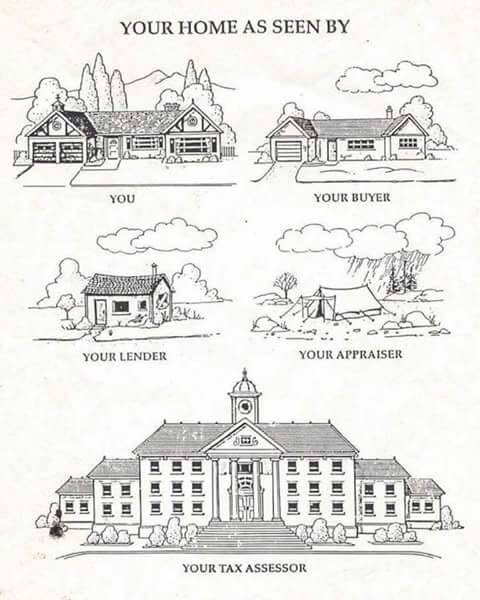

Also I checked my credit score about an hour ago and apparently I am in collections for medical stuff in Denver while I was there...and have been for a while. I never got any mail at the place I left (I talk to the guy who lives there) and I didn't get anything forwarded to my new address (filed some paperwork with USPS for that).

I paid the $100 with the hospital and found the place that was responsible for collections on my account. I called and asked them what was up and if anything happened to the mail being sent out - they said it was returned to sender. I asked them the address they had on file - they said WE county line road. West East.

So the lady talked to her supervisor about getting the collection account removed and they said they would and that I'd see it next month. I had to give them my social for them to find me though. Kind of worried about that but they did have all of my information. Including the almost right address, how much the collection amount was, phone number, etc.

"

"