You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

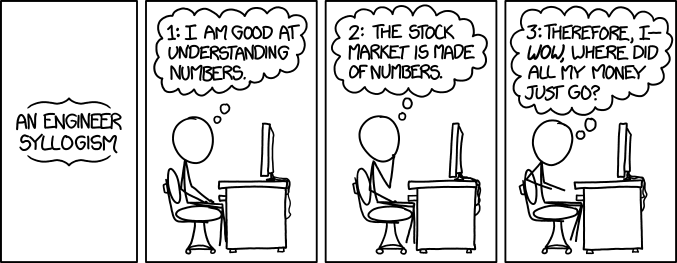

Good advice for engineers today

- Thread starter JeffDG

- Start date

EppyGA

Touchdown! Greaser!

gkainz

Final Approach

BTDT - got the t-shirt. Then got a financial manager.

First thing I learned - "Exit strategy is not 'when the money's gone, you exit the market.'"

First thing I learned - "Exit strategy is not 'when the money's gone, you exit the market.'"

Somedudeintn

Cleared for Takeoff

I'm an engineer and am good with numbers... Fortunately for me I started investing in the market in 2008 and am primarily in cheap index funds. Maybe when my portfolio gets bigger I will hire a financial manager but right now I'm liking my low fee vanguard funds.

Thumper

Pre-takeoff checklist

Checkout_my_Six

Touchdown! Greaser!

we just need more hope and change....

Mistake Not...

Cleared for Takeoff

- Joined

- Jun 18, 2013

- Messages

- 1,251

- Display Name

Display name:

Mistake Not...

Where'd it go? Oh, let's see:

* Massively short AMZN right before earnings when Bernanke did his first rate cut and my stops didn't save me.

* Bunch of TLT puts that played on the whole "surely the fed can't keep this up, the bond market won't let him"

* Held SRS waaaaay too long (daily inverse funds decay...)

* Short SPX from 1900 because "no way this keeps going, fed surely can't..."

Also violated my own trading rules and got burned each time. Now I'm smarter, much more patient and now have a loss to back up every single trade rule.

* Massively short AMZN right before earnings when Bernanke did his first rate cut and my stops didn't save me.

* Bunch of TLT puts that played on the whole "surely the fed can't keep this up, the bond market won't let him"

* Held SRS waaaaay too long (daily inverse funds decay...)

* Short SPX from 1900 because "no way this keeps going, fed surely can't..."

Also violated my own trading rules and got burned each time. Now I'm smarter, much more patient and now have a loss to back up every single trade rule.

rpadula

En-Route

Where'd it go? Oh, let's see:

* Massively short AMZN right before earnings when Bernanke did his first rate cut and my stops didn't save me.

* Bunch of TLT puts that played on the whole "surely the fed can't keep this up, the bond market won't let him"

* Held SRS waaaaay too long (daily inverse funds decay...)

* Short SPX from 1900 because "no way this keeps going, fed surely can't..."

Also violated my own trading rules and got burned each time. Now I'm smarter, much more patient and now have a loss to back up every single trade rule.

The market can stay irrational longer than you can stay solvent. :wink2:

(And inverse ETFs? Come on man those are wealth destroying inventions)

Mistake Not...

Cleared for Takeoff

- Joined

- Jun 18, 2013

- Messages

- 1,251

- Display Name

Display name:

Mistake Not...

(And inverse ETFs? Come on man those are wealth destroying inventions)

Yeah. But. I held SKF and LEH puts when Lehman blew up. That... was a good day.

My biggest problem is not math, but greed. "Bulls make money, bears make money, pigs get slaughtered." Had to learn that the hard way.

airdale

Pattern Altitude

- Joined

- Dec 30, 2007

- Messages

- 1,840

- Display Name

Display name:

airdale

Before you waste your money, study the S&P SPIVA and manager persistence reports.... Maybe when my portfolio gets bigger I will hire a financial manager but right now I'm liking my low fee vanguard funds.

Somedudeintn

Cleared for Takeoff

Before you waste your money, study the S&P SPIVA and manager persistence reports.

That's primarily why I'm staying with low cost index funds for now. I'm a buy and hold investor and until I wouldn't take any of my money elsewhere until I could see consistent returns better than the s&p including fees with equal or less risk.

kyleb

Final Approach

- Joined

- Jun 13, 2008

- Messages

- 7,555

- Location

- Marietta, GA

- Display Name

Display name:

Drake the Outlaw

Any time people talk investing, I'm reminded of the old line about the broker taking a potential customer to lunch at the yacht club.

Planner: "And over there are all of the partners' yachts."

Prospective Customer: "Where are the clients' yachts?"

Planner: "And over there are all of the partners' yachts."

Prospective Customer: "Where are the clients' yachts?"

airdale

Pattern Altitude

- Joined

- Dec 30, 2007

- Messages

- 1,840

- Display Name

Display name:

airdale

There is a mountain of research that says it is impossible to identify such a manager ahead of time. It happens but can only be determined using a rear-view mirror.... until I could see consistent returns better than the s&p including fees with equal or less risk.

AFIK there is no data to support the idea that investing with a "professional manager" is wise. There is no shortage of anecdotes and groundless statements of belief in the concept, however. All of the publications that rely on advertising revenue from these leeches are full of them.

Why do you think that the industry is opposing the fiduciary rule?