Is there supposed to be an attachment? If so, I can't see it.

There are three parts to an insurance policy: 1) the dec sheet "the declarations", 2) the body and 3) the endorsements. Without all three, you cannot determine what coverage you have. It is these three items that comprise your policy.

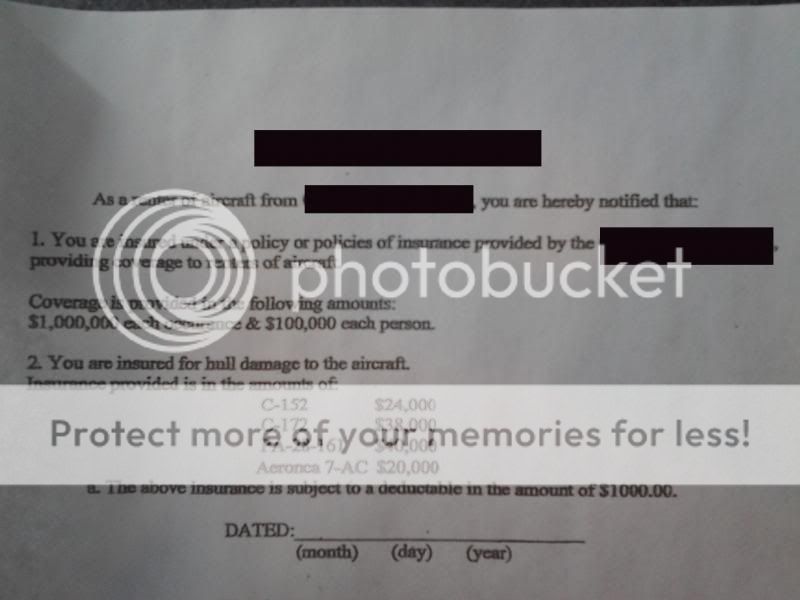

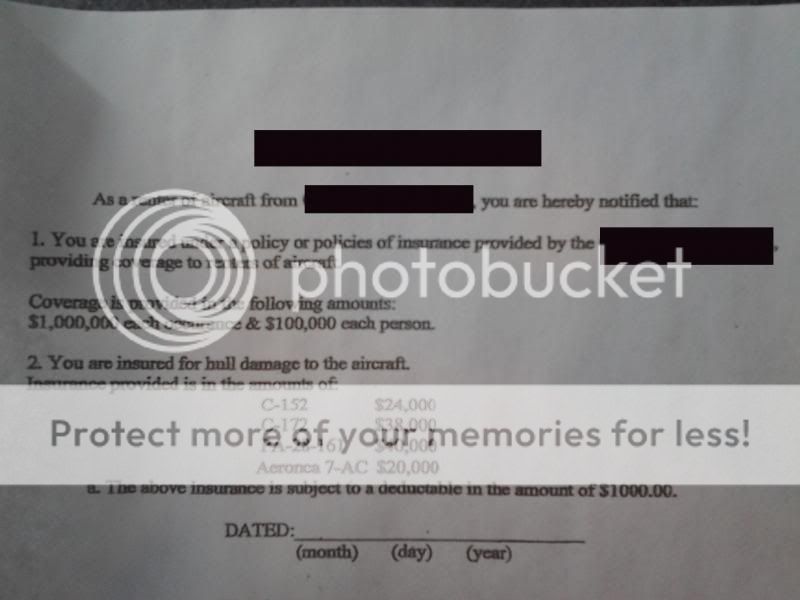

I am guessing (but I don't see the document your are refering to) that you are looking at just a dec sheet. That will tell you who is insured, what the limits are, and generally which forms are part of the policy. If so, it doesn't have any discernable meaning without the other two parts of the policy.

Alternatively, you might be looking at a certificate of insurance, which is evidence of coverage, but isn't the insuring agreement. It doesn't mean anything, other than that coverage was in place on the date it (the certificate) was issued. It doesn't really tell you what those coverages are. (Again, you need to read all three parts of the policy to make that determination.) Sometimes, a certificate will make a representation to a specified third person that coverage is in place, and won't be rescinded without some kind of notice. That can in some states create a third party beneficiary status in the third party with respect to the coverage such that they can't just stop coverage without giving the required notice to that third party.