RotorAndWing

Final Approach

- Joined

- Sep 5, 2008

- Messages

- 8,496

- Location

- Other side of the world

- Display Name

Display name:

Rotor&Wing

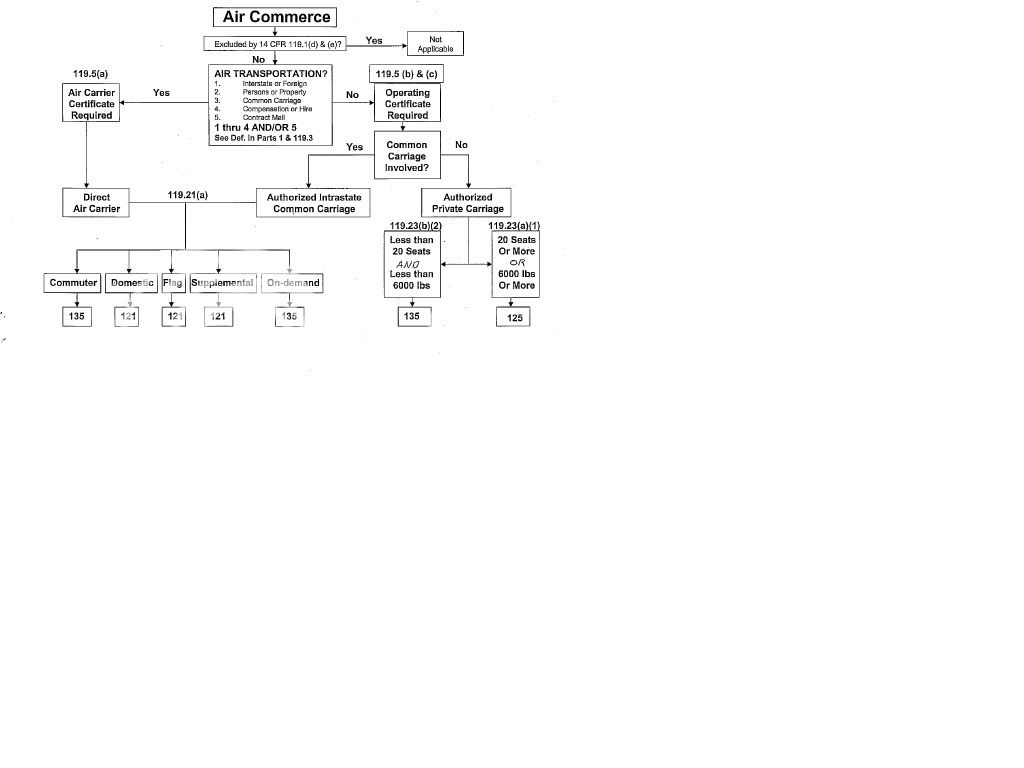

I have a related question about reimbursements for people with a commercial license. I don't have one, but when I get the hours I don't see that much reason not to. I think it was Ron that mentioned "company pilot." How does that work relative to part 119 operations? You can receive compensation for carrying passengers without being a 119 operation?

The way the FAA looks at it is "are you holding out to the public for transportation?"

If your operation is "holding out", i.e. advertising transportation services for sale then it falls under 121, 125, 135, etc. If you are not holding out but your operation is for the benefit of the company (corporate) then it falls under Part 91.