MultiMediaWill

Pre-takeoff checklist

- Joined

- Oct 29, 2012

- Messages

- 246

- Display Name

Display name:

Will

I am looking at the rental requirements for a flight school nearby. As a private pilot I am hoping to rent their Cessna 172, but they have a really high "renters insurance" requirement.

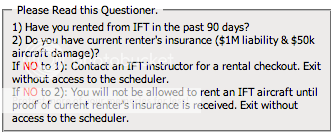

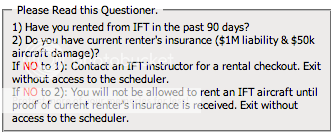

Their website lists these requirements:

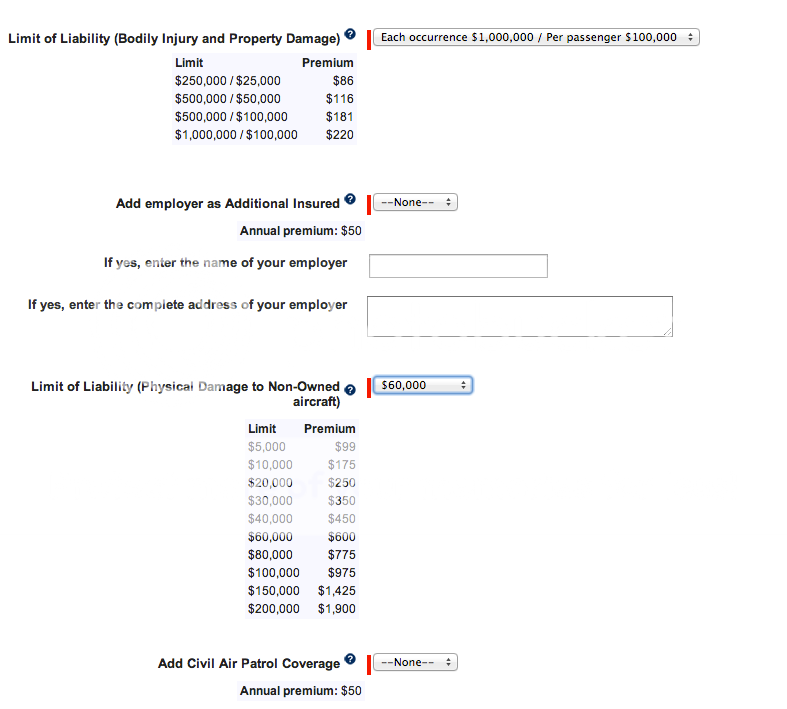

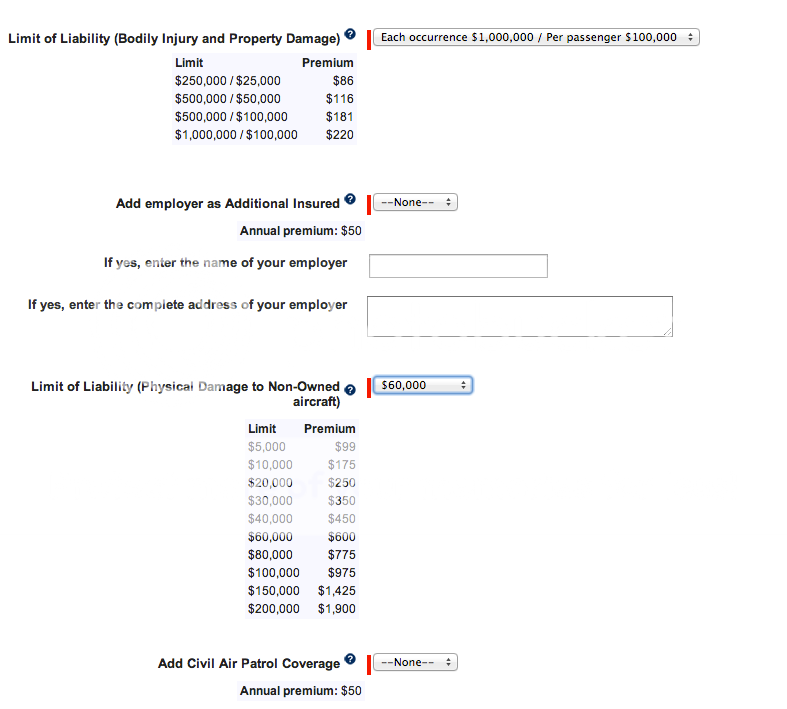

#2 says they want 1Mil Liability and 50K aircraft damage. Well looking at AOPA that would cost me $820 a year just for insurance.

Do you think that is fair? I haven't been able to rationalize renting from them because I don't think $820 a year is worth it to rent one airplane. The other flight school I rent from has a monthly fee of $30 but they cover insurance.

Their website lists these requirements:

#2 says they want 1Mil Liability and 50K aircraft damage. Well looking at AOPA that would cost me $820 a year just for insurance.

Do you think that is fair? I haven't been able to rationalize renting from them because I don't think $820 a year is worth it to rent one airplane. The other flight school I rent from has a monthly fee of $30 but they cover insurance.

Sounds reasonable to me.

Sounds reasonable to me.