I have heard this more than once...

Is it another pilot letting me know he has money?

I would like to know how many pilots have borrowed money for their airplane.

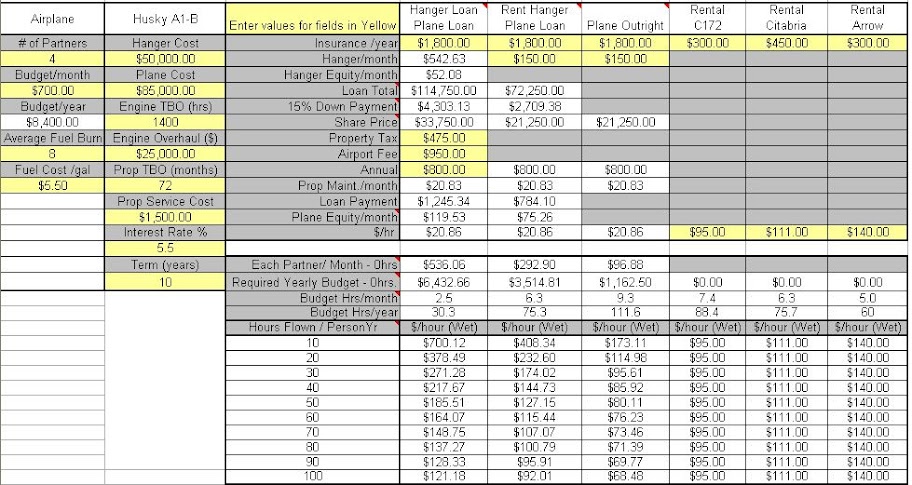

What if i consider the bottom line for monthly costs if i go through a hard time and stop flying for a few weeks

Hanger or tie down

monthly payment for plane loan

insurance

ALSO: I am a fan of the fact that when the plane is payed off my personnel worth has gone up (airplane equity). Maybe getting there has cost lots more per hour flying but i will have something after all those hours, even if the value has gone down.

Is it another pilot letting me know he has money?

I would like to know how many pilots have borrowed money for their airplane.

What if i consider the bottom line for monthly costs if i go through a hard time and stop flying for a few weeks

Hanger or tie down

monthly payment for plane loan

insurance

ALSO: I am a fan of the fact that when the plane is payed off my personnel worth has gone up (airplane equity). Maybe getting there has cost lots more per hour flying but i will have something after all those hours, even if the value has gone down.