topgun260

Pre-takeoff checklist

- Joined

- Dec 21, 2013

- Messages

- 303

- Display Name

Display name:

Topgun260

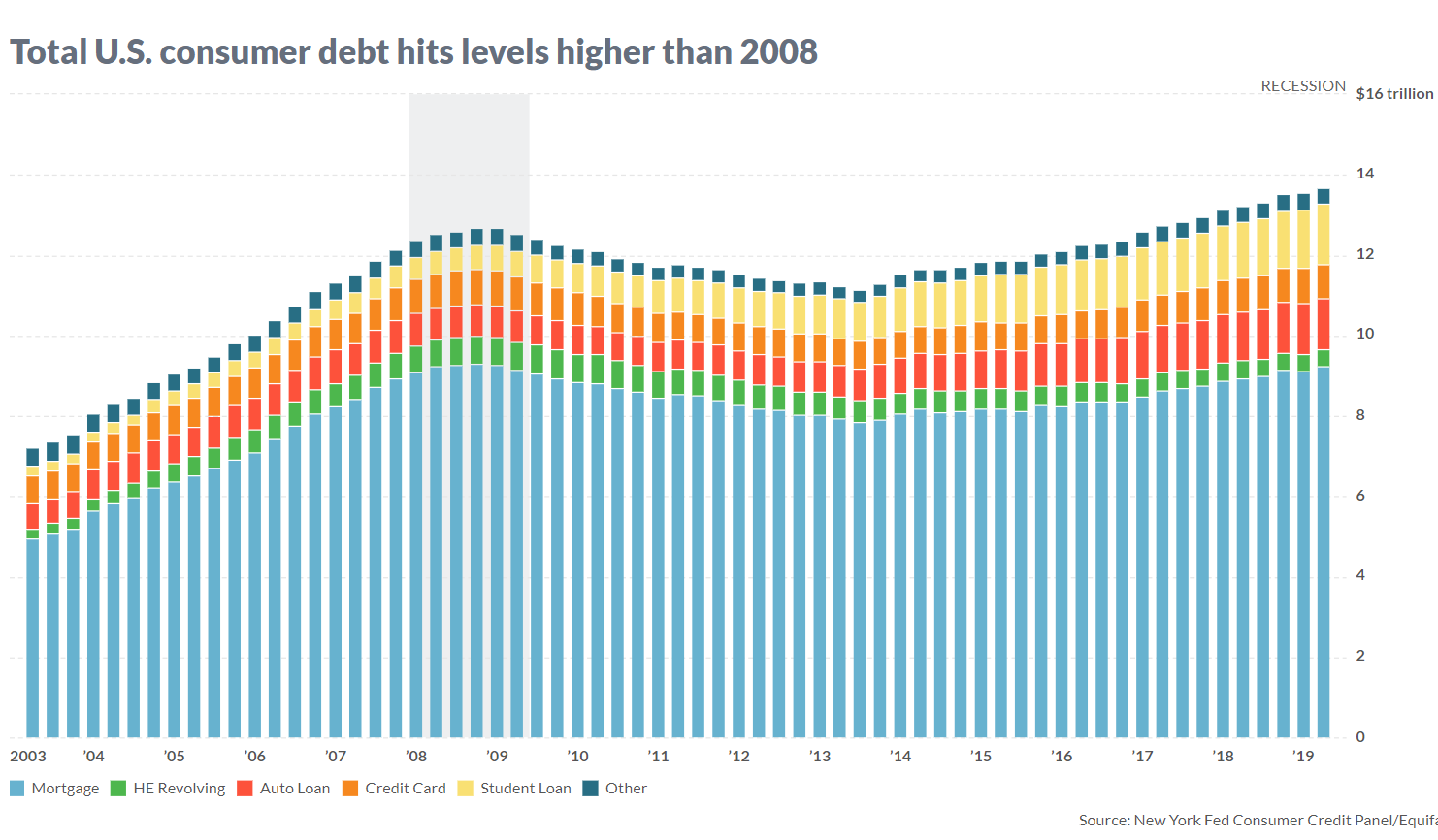

Going to need more than an inverted yield curve and “we’re past due” to support that recession claim. Generally recessions have a large bubble that gets corrected in the market (dot com, mortgages) Is there a particular bubble you think is getting ready to have a large correction? Consumer debt? Fed monetary policy?

I'm not sure who you were quoting when you said "we're past due" because I didn't say that. I'm not making any "recession claim" either. All I am saying is that historically, an inverted yield curve resulted in a recession roughly 1 year later.