eetrojan

Pattern Altitude

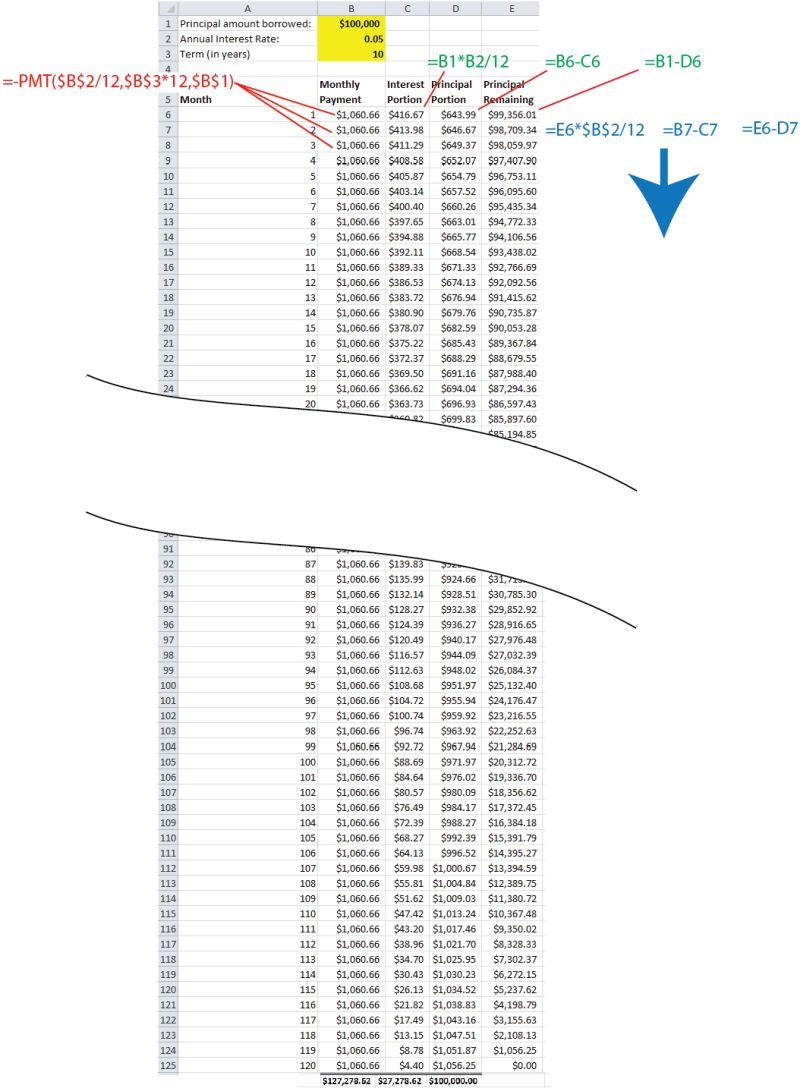

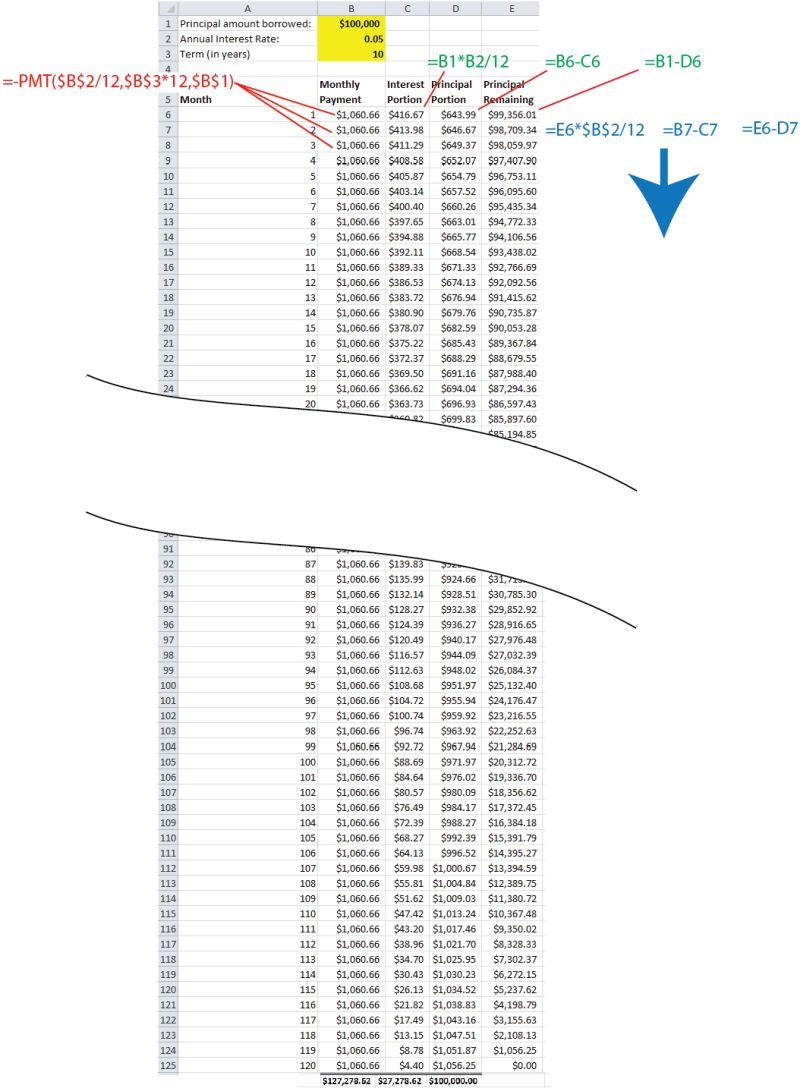

Bryan, the "amortization" formula in post 9 is the basis for figuring stuff out, and pen and paper is fine, but if you want to slap it into a spreadsheet, just use the payment function ("PMT") because it already has that formula built into it.

PMT (rate, nPer, pv)

where,

rate = interest rate (.05/12 for you)

nPER = number of periods (10 years x 12 for you, or 120 monthly periods)

pv = Present Value (for you, the amount loaned, e.g. $100,000).

The spreadsheet looks like this and it shows you how the monthly payment stays the same, while the interest portion reduces over time and the the principal portion grows over time.

You can fiddle with the yellow numbers to see how your monthly payment varies:

PMT (rate, nPer, pv)

where,

rate = interest rate (.05/12 for you)

nPER = number of periods (10 years x 12 for you, or 120 monthly periods)

pv = Present Value (for you, the amount loaned, e.g. $100,000).

The spreadsheet looks like this and it shows you how the monthly payment stays the same, while the interest portion reduces over time and the the principal portion grows over time.

You can fiddle with the yellow numbers to see how your monthly payment varies: